Back ܪܒܝܬܐ ARC Лихварство Bulgarian Usura Catalan Lichva Czech Åger Danish Zinswucher German Faizci DIQ Τοκογλυφία Greek Uzuro Esperanto Usura Spanish

This article needs additional citations for verification. (May 2024) |

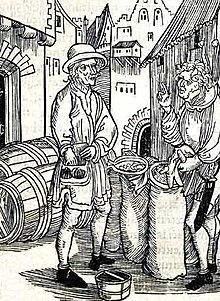

Usury (/ˈjuːʒəri/)[1][2] is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a usurer, but in modern colloquial English may be called a loan shark.

In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal.[3] During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury.[4] Similar condemnations are found in religious texts from Buddhism, Judaism (ribbit in Hebrew), Christianity, and Islam (riba in Arabic).[5] At times, many states from ancient Greece to ancient Rome have outlawed loans with any interest. Though the Roman Empire eventually allowed loans with carefully restricted interest rates, the Catholic Church in medieval Europe, as well as the Reformed Churches, regarded the charging of interest at any rate as sinful (as well as charging a fee for the use of money, such as at a bureau de change).[6] Christian religious prohibitions on usury are predicated upon the belief that charging interest on a loan is a sin.

- ^ "Usury". Oxford English Dictionary. Oxford University Press. 2012. Retrieved 26 October 2012.

- ^ The word is derived from Medieval Latin usuria, "interest", or from Latin usura, "interest"

- ^ "Americans for Fairness in Lending - The History of Usury". 15 October 2008. Archived from the original on 15 October 2008.

- ^ Jain, L. C. (1929). Indigenous Banking In India. London: Macmillan and Co. pp. 4–6. OCLC 4233411.

- ^ Karim, Shafiel A. (2010). The Islamic Moral Economy: A Study of Islamic Money and Financial Instruments. Boca Raton, FL: Brown Walker Press. ISBN 978-1-59942-539-9.

- ^ Cite error: The named reference

Cox1853was invoked but never defined (see the help page).